AvaxFi Lending Platform

The AvaxFi Lending Platform is a pool-based decentralized lending protocol built on Avalanche’s C-Chain (Ethereum compatible Avalanche Network). In most Defi platforms, the borrowing side obtains a loan from the platform by depositing collateral as security for the loan. In this model, which is called over-collateralization, the loan generally corresponds to 75% of the collateral. If the collateral is not ETH or BTC or (WETH-WBTC), this percentage is becoming even smaller. AvaxFi platform aims to provide borrowers with a higher loan rate against collateral. By increasing the number of borrowers, the platform consequently targets to increase the interest-earning of the lenders. By building on Avax blockchain, AvaxFi platform will provide its users with faster transactions and cheaper network fees for transferring assets.

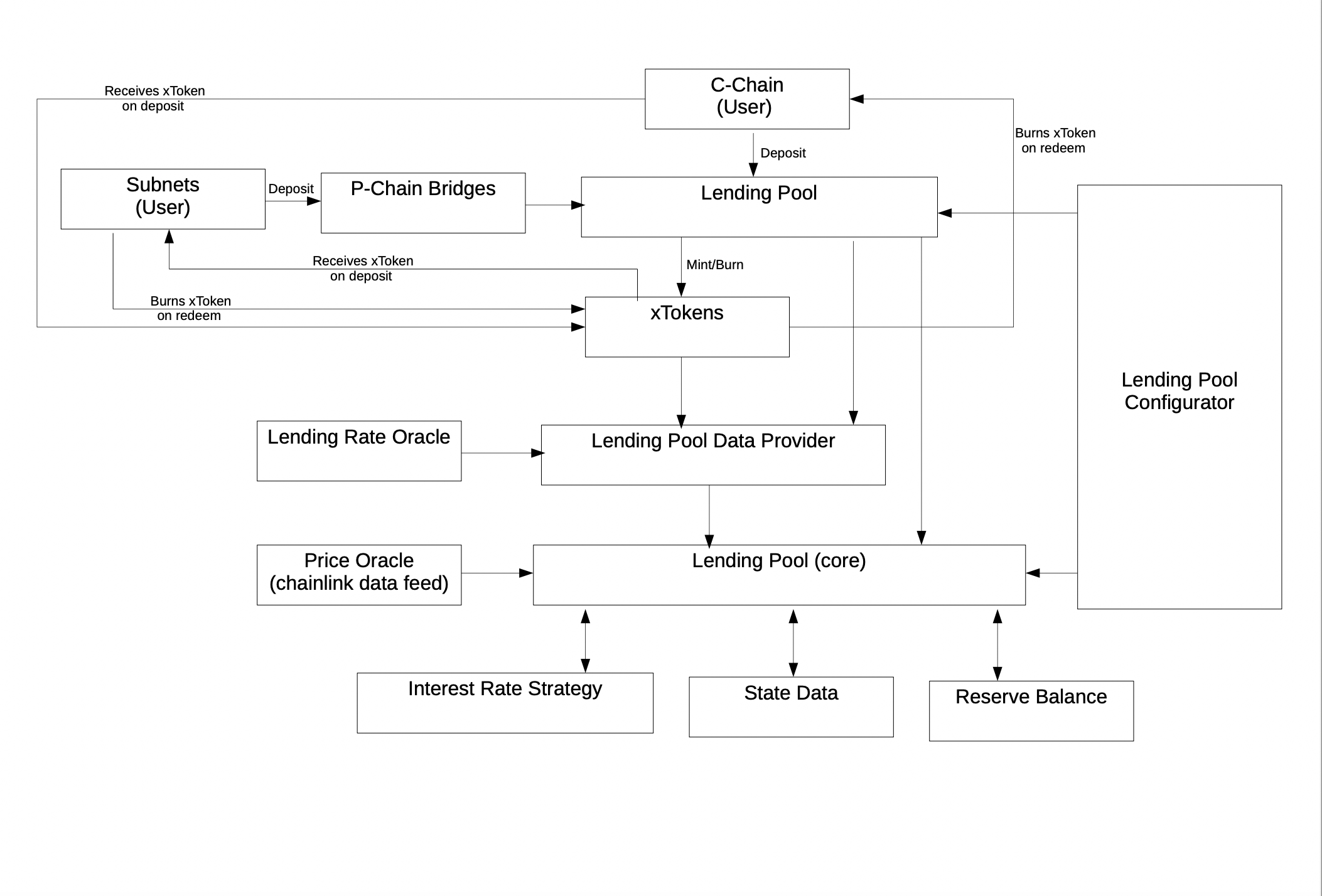

The Protocol will work as a pool based lending Protocol. It will be a fork of the Aave Protocol, which is quite easy to implement since Avalanche is EVM compatible. It will work as follows. The Lending Pool Core contract will be the center of the Protocol and holds the state of every reserve and handles basic logic. The Lending Pool Data Provider performs calculations like the average loan to value and average liquidation ratio. It also provides data to the Lending Pool contract. The Lending Pool contract interacts with the reserves by using the Lending Pool Core contract and the Lending Pool Data Provider. It also mints or burns the xToken when a user deposits or redeems. The xToken represents the tokenization of the lending position, which means when a user deposits money he gets a the equal amount of it in xToken which than increase until they are burned. The lending pool configurator provides configuration functions to the Lending Pool and Lending Pool Core contracts.The Interest Rate Strategy contract updates interest rates of specific reserves with every reserve having a specific interest rate strategy. To get the lending rate and the current price of a specific asset for the Lending Pool Core and the Lending Pool Data Provider, the Protocol will use external Oracles. In order to use the full Potential of the Avalanche Plattform bridges to different Subnets on the P-Chain will be implemented, so that users who aren’t using the Avalanche C-Chain can still use the Protocol. To conclude the Protocol will use a fork of the Aave Protocol which will be deployed on the C-Chain and will use bridges to connect to users of different Subnets on the P-Chain.

Last updated